Currency Trading: Your Ultimate Guide to Getting Started

Currency Trading

What is Currency Trading?

Currency trading, also known as forex trading, involves buying and selling currencies to profit from changes in their exchange rates. It takes place in the foreign exchange (forex) market, the world’s largest and most liquid financial market, where daily trading volumes reach trillions of dollars. This guide offers beginners a clear path to understanding and starting currency trading with confidence.

How the Forex Market Works Currency Trading

The forex market operates 24 hours a day, five days a week, across major financial hubs like New York, London, Tokyo, and Sydney. It’s a decentralized market where banks, institutions, and individual traders exchange currencies. Prices fluctuate based on supply and demand, influenced by economic data, interest rates, and global events.

Essential Forex Concepts

To start trading, you need to understand these key terms:

- Currency Pairs: Currencies are traded in pairs, like GBP/USD (British Pound vs. US Dollar). The first currency is the base, and the second is the quote currency, showing how much of the quote currency buys one unit of the base.

- Pip: A pip (point in percentage) measures the smallest price change in a pair, typically the fourth decimal place (e.g., 1.2345 to 1.2346 is one pip).

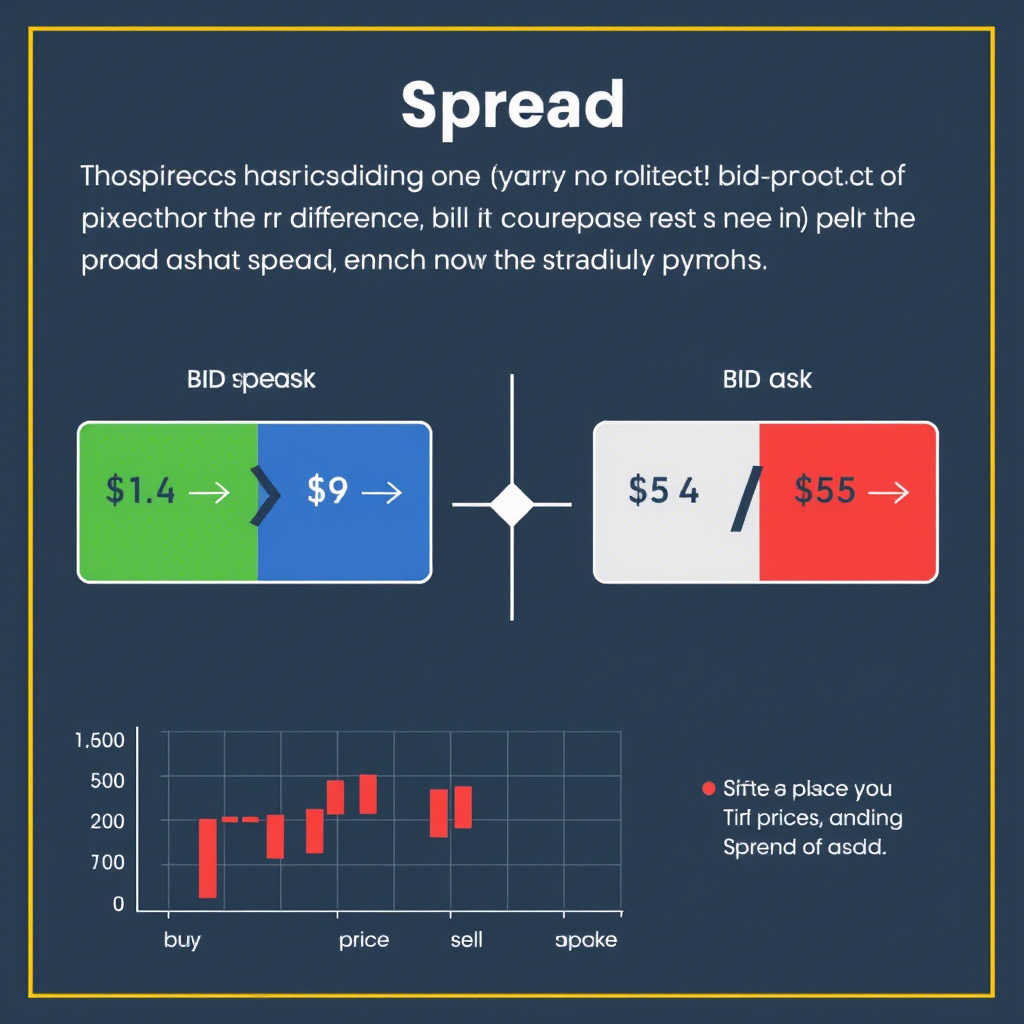

- Spread: The gap between the bid (sell) and ask (buy) prices, representing the broker’s fee.

- Leverage: Allows control of large positions with small capital (e.g., 50:1 leverage means $1,000 controls $50,000). It amplifies both profits and losses.

- Margin: The deposit required to open a leveraged trade.

- Lot Size: Trades are measured in lots. A standard lot is 100,000 units of the base currency; a micro lot is 1,000 units.

Steps to Start Currency Trading

- Learn the Basics: Study forex concepts, market mechanics, and trading strategies through books, online courses, or tutorials.

- Choose a Reliable Broker: Select a regulated broker with competitive spreads, a user-friendly platform, and strong customer support.

- Open an Account: Start with a demo account to practice risk-free or a live account with real funds.

- Develop a Trading Plan: Define your goals, risk tolerance, and strategy to stay disciplined.

- Analyze the Market: Use two main approaches:

- Technical Analysis: Analyze price charts with tools like moving averages, Bollinger Bands, or Fibonacci retracement to predict trends.

- Fundamental Analysis: Track economic indicators (e.g., inflation, employment) and news events affecting currency values.

- Execute Trades: Decide to buy (go long) if you expect the base currency to rise or sell (go short) if you predict a decline.

- Monitor and Manage: Use tools like stop-loss orders to limit losses and take-profit orders to lock in gains.

Trading Strategies for Beginners

- Trend Trading: Follow the market’s direction using indicators like moving averages to identify uptrends or downtrends.

- Range Trading: Trade within a stable price range, buying at support levels and selling at resistance.

- Breakout Trading: Enter trades when prices break through key levels, indicating a potential new trend.

- News Trading: Capitalize on price movements triggered by major economic announcements, but beware of volatility.

Risk Management Essentials

Currency trading is high-risk due to volatility and leverage. Protect your capital with these practices:

- Risk Per Trade: Limit risk to 1-2% of your account balance per trade.

- Stop-Loss Orders: Set automatic exit points to cap losses.

- Avoid Overleveraging: High leverage can wipe out accounts quickly if trades go wrong.

- Stay Disciplined: Follow your plan and avoid emotional decisions driven by fear or greed.

Tips for New Traders

- Practice First: Use a demo account to test strategies and build confidence.

- Keep a Trading Journal: Record trades to analyze performance and learn from mistakes.

- Stay Updated: Monitor economic calendars for events like central bank decisions or GDP releases.

- Start Small: Begin with micro lots to minimize risk while learning.

- Be Patient: Success takes time; focus on consistent progress over quick wins.

Common Mistakes to Avoid

- Overtrading: Taking too many trades or large positions can lead to significant losses.

- Ignoring Risk Management: Skipping stop-losses or risking too much capital is dangerous.

- Chasing Losses: Trying to recover losses with impulsive trades often worsens outcomes.

- Lack of Knowledge: Trading without understanding the market increases failure rates.

Tools and Platforms

Popular trading platforms like MetaTrader 4 or 5 provide charting tools, indicators, and automated trading options. Most brokers offer mobile apps for trading on the go. Choose a platform that suits your needs, with features like real-time data and easy order execution.

Psychological Aspects

Trading requires mental discipline. Fear and greed can lead to poor decisions, like holding losing trades too long or exiting winners too early. Develop a routine, stick to your strategy, and avoid letting emotions drive your actions. Regular breaks and a clear mindset improve decision-making.

Building Long-Term Success

Currency trading isn’t a get-rich-quick scheme. It demands continuous learning, practice, and adaptation. Study market trends, refine your strategies, and stay informed about global events. Over time, small, consistent gains can compound into significant results if you manage risks effectively.

Conclusion

Currency trading offers exciting opportunities for profit but comes with substantial risks. Beginners should prioritize education, practice with demo accounts, and adopt strict risk management. By starting small, staying disciplined, and continuously improving, you can navigate the forex market with greater confidence and work toward sustainable success. Approach trading as a skill to be mastered, not a gamble, and always trade within your means.

.